Halal or Haram: Navigating Home Finance in the Islam

Running a home is a big milestone when you look at the anybody’s lifestyle. It is really not just a monetary choice; it is also a spiritual and you can ethical you to, particularly for devout Muslims. When we look into the brand new the inner workings of shopping for a home, specifically with regards to financial support, we have been had the endless question: Can it be halal (permissible) otherwise haram (forbidden)?

Knowledge Halal and you can Haram

Regarding the arena of Islam, steps and you will choices are usually led because of the its classification on the halal or haram. This improvement basically means one step or item are both permissible otherwise taboo, correspondingly, about eyes of Allah and his Messenger.

Which quality was foundational. New Muslim faith stresses you to both halal and haram was ordained from the Allah and his Live messenger. Because Surat Al an’am mentions:

Historical Perspective regarding Usury (Riba)

To know new Islamic stance toward usury otherwise riba, it is important to go through the historic perspective. Into the pre-Islamic Arabia, usury is actually a common habit. Moneylenders tend to cheated the indegent from the financing currency at the too much attract pricing, resulting in cycles out-of never ever-end personal debt. The fresh forbiddance of riba, as previously mentioned regarding the Quran, is actually a revolutionary action on end it exploitative system.

New prohibition out of riba was not simply a financial demand however, an alternative method, adding ethical, ethical, and you may personal proportions. By removing the brand new excesses from usury, Islam promoted a best economic climate, where in actuality the wealthy couldn’t unjustly enjoy the financial difficulties regarding anybody else.

Real estate and its particular Money inside the Islam

- The house or property itself is halal.

- The point otherwise use of the property is permissible.

- The cash useful for their buy are halal.

A problem for the majority potential Muslim property owners is exactly how to money the acquisition versus turning to antique banking assistance you to definitely include riba (desire or usury), which is clearly prohibited inside the Islam.

Regardless of the understanding about this ban, discussions occur. Certain might cite a beneficial fatwa regarding the CEFR, recommending exclusions on usury rule. Although not, even one fatwa emphasizes the new sinfulness out of riba, so it’s clear one deviations regarding upright roadway come with spiritual effects.

The trail Forward getting Muslims

Islam cannot mandate a house ownership. Yet not, it will recommend providing defense for your friends. Brand new emphasis is found on lawful possession and you can resources.

Its important for Muslims to keep up independence, whether it’s in the property otherwise occupation. Owning property otherwise entering enterprising possibilities are laudable since it improves the fresh new Muslim people. But you must consider, while the Prophet (tranquility end up being through to your) conveyed:

Leasing vs. Buying: A keen Islamic Position

Believe it or not, leasing is not similar to throwing money the actual window. It is more about rewarding the fundamental need for shelter. Renting might give liberty, while you are to find ensures a lot of time-identity balance. Yet, the selection might be really-considered, without rash judgments, specially when navigating the difficulties out-of financing into the a good halal fashion.

Solution Money Opportunities

In the event that having a house looks difficult, most other halal financial support streams are worth exploring. Thought to shop for assets from inside the Muslim-bulk places, where in actuality the will set you back could well be all the way down, therefore the financial investments line up more directly which have Islamic beliefs.

The new Philosophical Underpinning off Halal Financial support

Islamic loans operates on concept away from exposure-sharing and you can house-situated money. In lieu of traditional economic expertise, which happen to be based the weblink on the import regarding risk, Islamic fund emphasizes partnerships, joint ventures, and you will mutual collateral financing.

For instance, rather than loaning money and charging you desire, Islamic financial institutions get into a partnership contract employing clients. Both parties contribute financial support, share the risk, and dispersed profits or losses accordingly. That it thinking fosters an environment of shared obligation, mutual respect, and you will guarantee.

Latest Alternatives for Halal Home financing

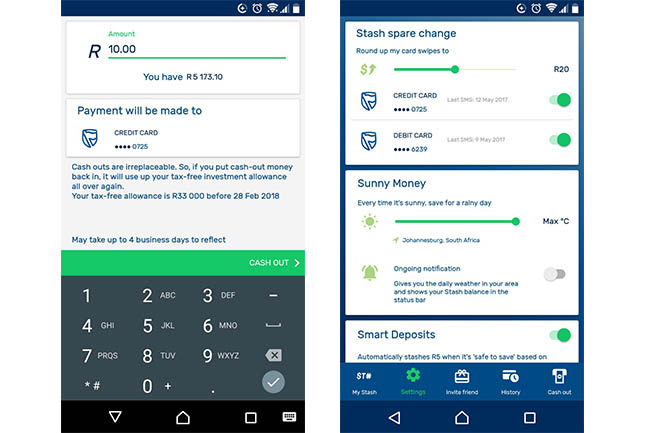

Familiar with this new financial restrictions Muslims deal with considering the prohibition of usury, several Islamic loan providers are seen, providing sharia-compliant a mortgage possibilities. Below are a few:

Musharaka (Union Capital): The bank in addition to homebuyer as one purchase the property. The consumer upcoming gradually buys from bank’s express over the years.

Murabaha (Cost-Also Financing): The bank sales the property following carries it into buyer at the a return. Unlike attention, the customer pays a fixed, large price for the installments.

Ijara (Lease-to-Own): The financial institution purchases the property and you may rentals it on the consumer. At the conclusion of the fresh book identity, the customer has a solution to purchase the possessions on an effective pre-computed price.

Muslims looking to buy a property possess some options to carry out therefore instead decreasing the religious prices. Of the going for halal resource, they not only follow their believe in addition to render an excellent so much more equitable and you can reasonable economic climate.

Conclusion: Prioritizing Spirituality More than Materialism

For the Islam, measures are not just about their economic outcomes. Their spiritual outcomes is vital. Is it better to own assets within this brief world within the possibility of displeasing Allah, or even focus on eternal serenity throughout the hereafter?

Hadiths and you can Qur’anic passages stress new perks when you look at the heaven of these who happen to live righteously, reminding united states your real essence out-of life is not restricted so you can this world.

This existence the following is not totally all fun and you may game. The new Property beyond is real-world. If they simply realized!

Just like the Muslims browse the causes out of a residential property and you can investment, it is vital to remember that our measures right here reflect into the eternity. Choose prudently, prioritize their believe, and always seek the way you to provides you nearer to Allah.