Household guarantee fund allows you to make use of your home guarantee to gain access to cash flow for medical emergencies, home renovations, and you can other things needed finance having. When you have extreme equity of your property, you may have solutions regarding obtaining a loan.

A beneficial Georgia house equity loan also provides several benefits, as well as aggressive interest rates and easier entry to cashflow. Find out how Griffin Funding can help you safe financial support for various costs with competitive family equity loan costs in the Georgia.

When you yourself have enough equity in your home, you need to use that guarantee because security to help you secure a property guarantee mortgage into the Georgia. Which have a fundamental home guarantee loan, you generally exchange some of the guarantee of your home having a lump sum payment of money, used getting any sort of you want.

You can find different kinds of domestic equity fund, it is therefore crucial that you research your facts before you apply. There are also conditions you need to satisfy to try to get an excellent Georgia domestic collateral loan.

As a general rule, loan providers will let you acquire up to 95 percent of one’s security you’ve got of your home – though some loan providers have an enthusiastic 80 per cent limit. You will get your loan from inside the a lump sum having good fixed interest rate, and therefore you’ll need to generate monthly installments up until your loan is actually paid down. You need to including repay your Georgia home guarantee loan prior to offering your home, if you don’t your debt you borrowed will be removed from the newest deals proceeds.

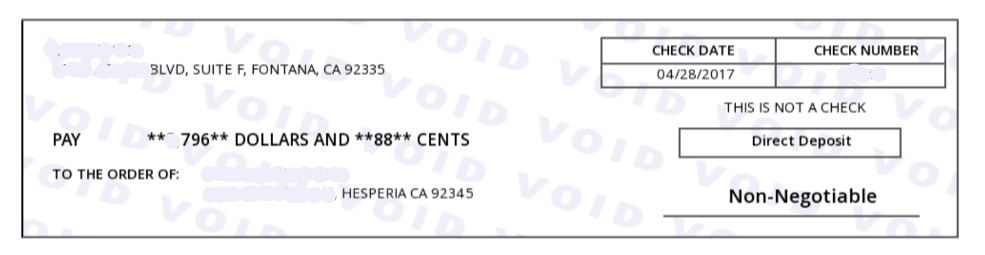

Your typically have to add W-2s and you may tax returns to try to get property guarantee loan, you is able to make an application for a no doc house equity financing by way of Griffin Resource if you find yourself self-operating.

Form of House Equity Loans

After you’ve felt like a Georgia family collateral mortgage is good getting you, it is time to choose which kind of mortgage you want to remove. You have got a few first choices: a home equity mortgage otherwise a home security credit line (HELOC). Home collateral funds and you will HELOC pricing inside Georgia may differ, so that your choice commonly apply to their payment per month.

Home collateral finance are fixed-speed funds that are paid to you personally in one single lump sum payment. As the interest rate will not changes, your monthly payment will stay an equivalent until the loan is repaid. The duration of a Georgia house security mortgage is normally between four and you may 40 years, in the event loan periods may vary.

While doing so, a home guarantee personal line of credit gives you a fixed purchasing restrict according to research by the quantity of collateral you have on your own house. Domestic equity personal line of credit cost in the Georgia are generally adjustable, so that your rate of interest can go up otherwise off founded for the market standards. Once a draw age of five otherwise ten years, draws was limited therefore the cost several months begins on the HELOC.

There isn’t any obvious-clipped better domestic equity financing , therefore it is important to assess your debts and pick an excellent loan that meets your bank account plus demands.

Benefits and drawbacks out of Georgia Family Collateral Financing

Domestic collateral funds are perplexing, which could make challenging to determine when the a house security mortgage suits you. Knowing the app procedure and you will house equity mortgage cost when you look at the Georgia helps you determine whether a good Georgia household equity loan is actually in your best interest.

- Access competitive interest levels.

- You don’t need to compromise the low-rate first mortgage to try to get that loan.

- Improve cashflow.

- Possibly write off house security loan appeal on your fees.

- Make use of the bucks you obtain to fund home improvements, do-it-yourself projects, medical expenses, tuition money, or anything else you’d like.

- Accessing guarantee to the primary residence, second family, otherwise investment attributes.

- Domestic security funds increases your own full debt burden.

- Failure to repay a beneficial HELOAN may cause the loss of your residence.

- Domestic guarantee financing rates and you may HELOC cost during the Georgia usually end up being large compared to the conventional no. 1 mortgages.

Focusing on how family equity fund really works makes it possible to make the best choice based on your financial situation. If you have questions, you could potentially call us before applying to have a good Georgia household equity loan.

Georgia Domestic Guarantee Mortgage Degree Conditions

Something you should remember is that there are particular criteria you must satisfy to qualify for a house collateral financing. Here are some of your standards to remember in advance of obtaining property security mortgage when you look at the Georgia:

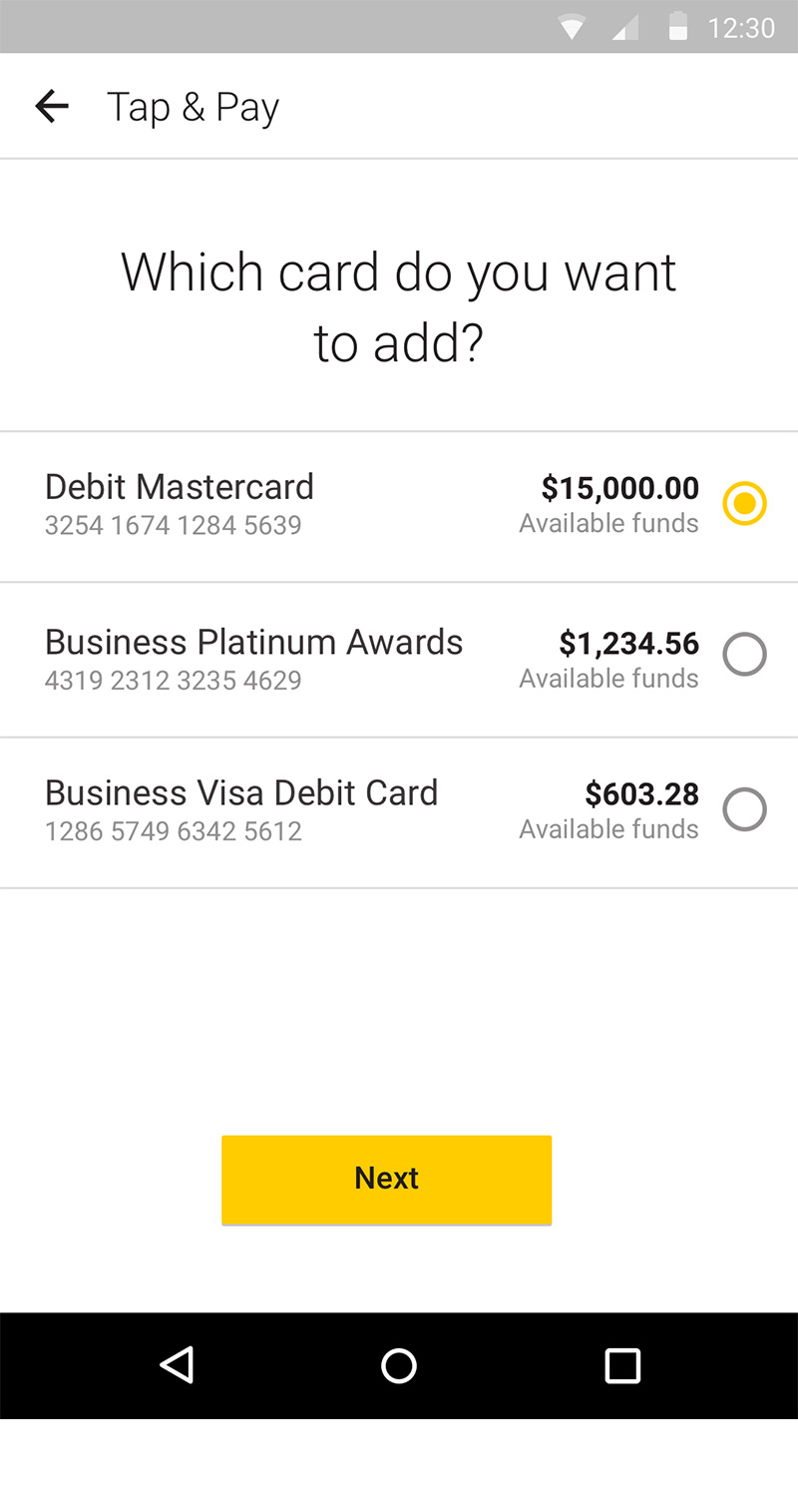

Staying towards the top of your own personal funds was a button region off being qualified to possess a house equity loan in the Georgia. You need to use new Griffin Silver software to test the credit rating, monitor your own home’s worthy of, and you will talk about funding choice. When you find yourself having problems qualifying getting family security financing into the Georgia, manage your funds to the Griffin Gold software.

Get a house Collateral Financing in Georgia

When you have collateral in your home, you may be entitled to a beneficial Georgia home security loan. Household security loans are really easy to qualify for for many who see the needs and you can aggressive interest rates generate HELOANs a good alternative if you wish to consolidate personal debt of personal loans and you may borrowing notes. not, it is important to evaluate the money you owe before you apply to have financing.

Do you want to apply for a house collateral loan or family collateral personal line of credit when you look at the Georgia fast cash loans Lowndesboro AL? Our company is right here to help. Use on the web otherwise contact Griffin Capital more resources for just how you can aquire recognized to possess a house guarantee loan and also have the money flow you want having crisis costs and you can family home improvements.