Secret Takeaways

The team which is most handicapped of the this type of rate of interest shocks is actually minorities. Black colored homeownership continues to be lower than fifty% to own black colored home.

Offense is lower americash loans Rico, locals was friendlier, and you can every person’s possessions values rise when they reside in a community out of owners, maybe not renters.

When you look at the featuring in the Bidenomics two weeks before from inside the Milwaukee, President Joe Biden erican dream. Then he went on the his scary whispering function and you will in hopes you it’s operating.

Is not a large ambition of one’s American fantasy owning a home? Biden enjoys and also make first-date homeownership more difficult to own young couples for a few factors. One is the complete jump for the rising prices as well as the slower boost in earnings and you may wages means that house are more costly. High home prices work with those who currently own their houses, but much of the increased really worth is due to standard inflation, and this reached a top out of 9% just last year and you can affects men.

More substantial toxin for basic-big date homeowners could have been the latest regular escalation in financial costs below Biden. As he came into place of work, the mortgage price is 2.9% nationally. Now its seven.1%, thanks within the zero small part towards the Federal Reserve’s 11 interest rate grows motivated because of the $6 trillion Biden using and borrowing spree within the 2021 and you may 2022.

Biden Is Destroying brand new American Dream of Homeownership

So now, according to mortgage company Redfin, just the rise in rates on the a 30-seasons home loan out of 5% in order to eight% means that a center-earnings family that will shortly after manage a median-value household out of $five hundred,000 can just only afford a property really worth $429,000.

High, save money and you score shorter family. Otherwise instead of just one-family home, you could only pay for good three-area condominium or a beneficial townhouse. Whenever we compare the rates now in the place of whenever Donald Trump is chairman, the common homebuyer is only able to pay for property with a cost level over $100,000 below three years back.

Just what a package? Maybe that is that need how big is a special home is actually smaller compared to in the past.

We have found another way to check out the ruin done by Biden policies: Should you want to buy a great $five hundred,000 household today, which is nearby the average rates in lots of preferred metropolises, the overall focus money will be at the very least $800 much more 30 days. It means more than 3 decades from repayments totaling no less than $250,000.

Definitely, rents is right up almost 20% as well, thus for the majority of 20-somethings, it means resting in the parents’ cellar.

Biden conversations much from the bridging holes anywhere between rich and you will worst and you may blacks and you will whites. Nevertheless the category which is really handicapped from the such interest rate surprises was minorities. Black colored homeownership is still lower than fifty% having black colored households. This new Washington Article phone calls so it tragic, nonetheless they fault racism, so good authorities formula.

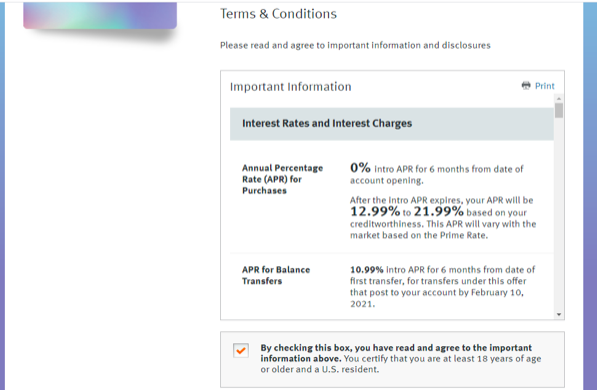

There’s another obstacle so you’re able to homeownership having Age group X and you may millennials. Many 31- and you will forty-somethings is hamstrung by the their established and you may expanding loans. Credit card debt has become $step one.03 trillion. 50 % of all of the families are essential to have trouble paying off it financial obligation every month. Delinquencies try ascending, that will suggest penalty prices off 20% in order to 25%.

Thus, in the event that parents can’t afford its existing personal debt, how have a tendency to it rating a financial to help you approve a beneficial $400,000 or more real estate loan?

Possibly Biden enjoys a key want to forgive trillions off bucks off mortgage obligations, as he has already made an effort to manage which have college loans. But that just changes your debt load to help you taxpayers-hardly a simple solution.

This new Biden administration’s physical violence towards the homeownership isn’t only damaging to the family which can be are valued out from the business. Its damaging to organizations and you can places in the nation. When group be property owners and set roots when you look at the an urban area, he is more expected to value besides improving her household and maintaining the fresh upkeep and you can buttoning a shirt and cutting brand new bushes, but it provides them with a share about schools and you can children locally in addition to quality of the general public properties. Put simply, homeownership brings Us americans a sense of Tocquevillian civic pride.

Offense is leaner, locals is friendlier, and everybody’s possessions values rise after they are now living in a residential district of owners, maybe not clients.

There was that reason to feel the present unpredictable manner would be reversed. Back into 1980, when Jimmy Carter try chairman, financial cost were not eight%; it attained a lot more than 17%. Voters rebelled against the monetary havoc and you will chased Carter of workplace. Ronald Reagan arrived to the new Light Household, in accordance with smarter economic fiscal principles, home loan prices easily dropped by 50 percent following down still. It does occurs once more.