We’re fully familiar with the many lender advice and can assist to decide which is best selection for your. Mouse click to go over your own case of bankruptcy mortgage possibilities with our team.

Refinancing After a personal bankruptcy

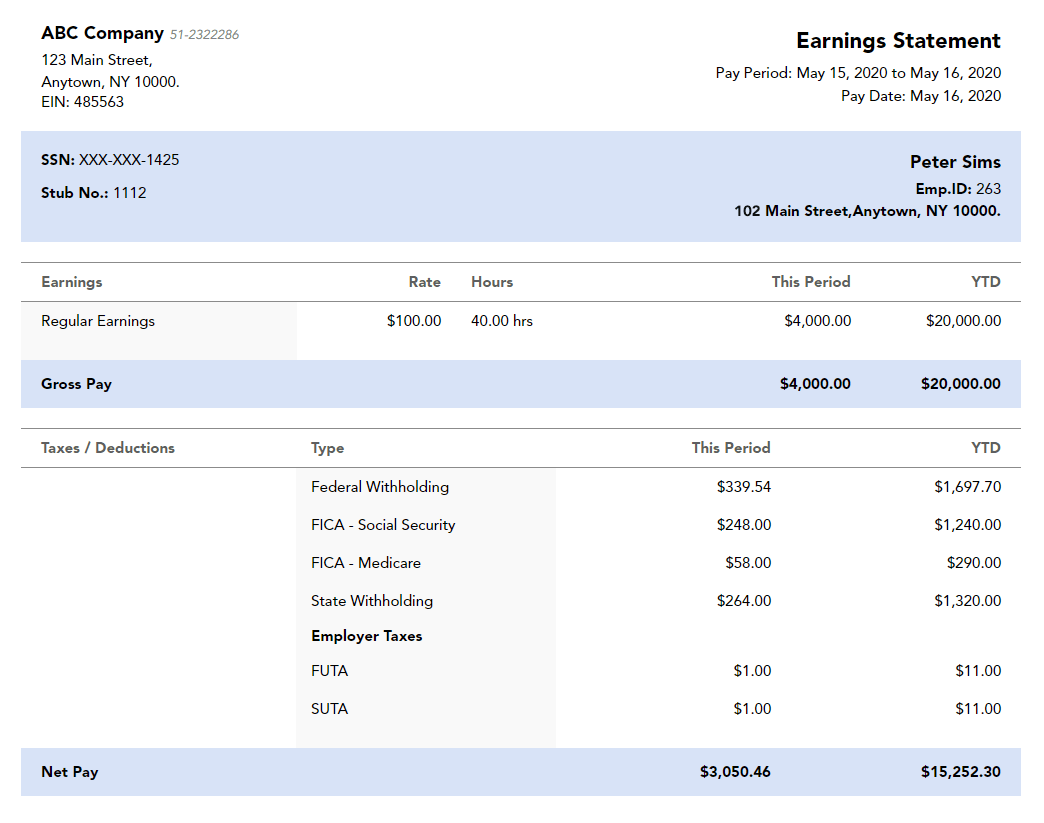

- The fresh advised amount borrowed in the place of the worth of your home (financing in order to really worth proportion)

- The credit scores just after the personal bankruptcy, start restoring their borrowing from online installment loans New York the bank

- Other compensating products such as your money and you will a career record

- Whether or not you’d present late mortgage repayments.

Leer másMust i Re-finance My Financial Immediately after Chapter 7 Personal bankruptcy?