This redlining map away from Poughkeepsie was one of several a huge selection of Domestic Safety Maps of towns produced by the house Owners’ Loan Firm (HOLC)

The latest law situated the usa Housing Power (USHA) one to given $five-hundred billion when you look at the fund getting lower-cost housing projects nationwide. Underneath the the new laws, brand new USHA acted as financing giving department to express and regional housing regulators to build reasonable-rates houses in small and large urban areas. By the end of 1940, over 500 USHA systems was ongoing or was completed, that have mortgage agreements out-of $691 million. The target would be to make program worry about-renewable through the distinctive line of rents: one-50 % of book regarding clients on their own, one-3rd repaid of the efforts about Federal government; and one-sixth paid from the annual contributions made by the fresh new localities by themselves. During the The second world war, new USHA try important within the think and you can design homes to have safety specialists.

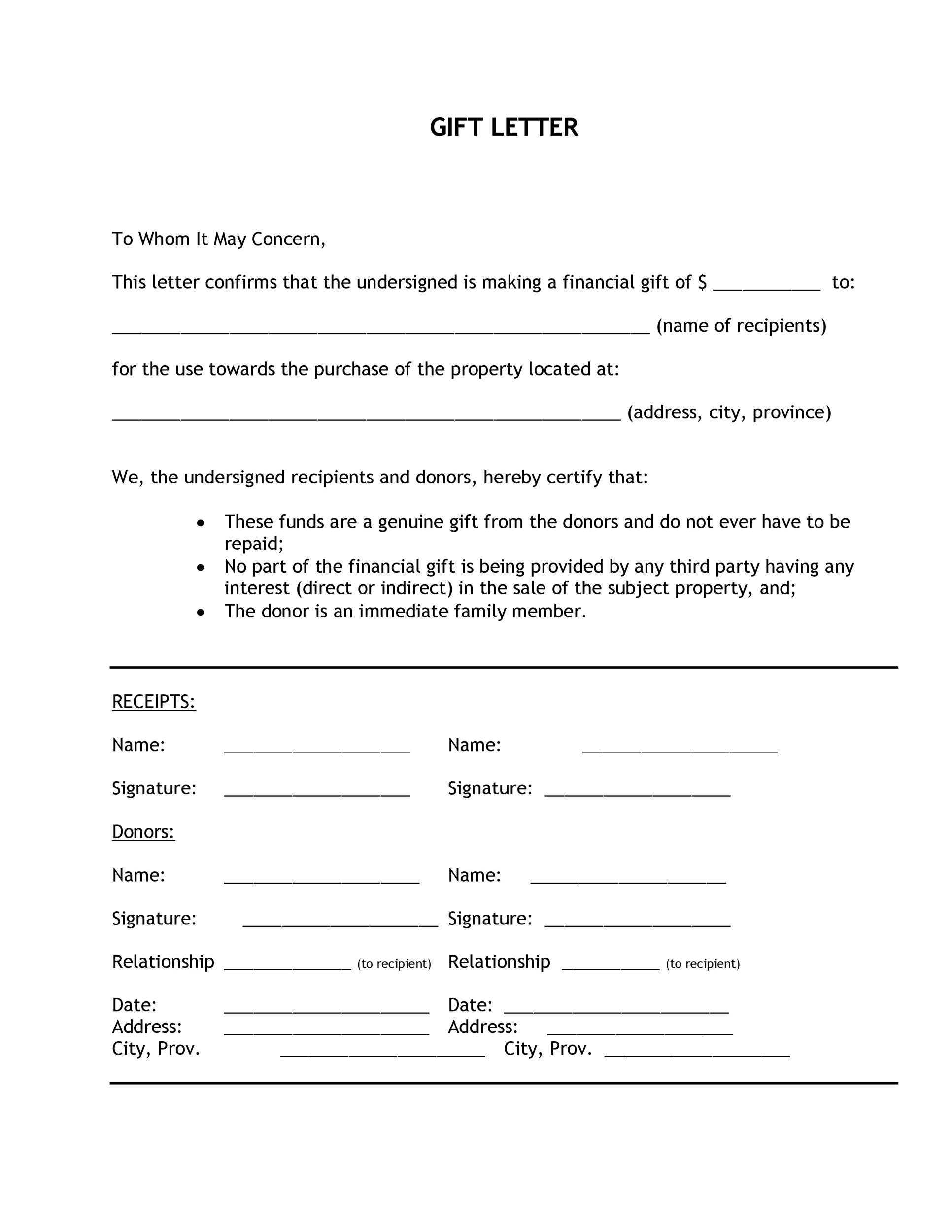

An effective Redline To Houses Guidance

These attempts normalized the housing industry and you may provided a path so you’re able to homeownership for years from Us citizens. However, bodies home loan laws and regulations have been also used to deny fund to help you African People in the us and maintain all of them within the segregated areas. The new loans in Redstone HOLC composed color-coded residential coverage charts regarding a huge selection of urban centers. Along with programming expressed places that was basically considered safer so you can point mortgagesmunities which have high African american communities were utilized in areas coded for the red for high risk. These maps determined the word redlining-describing an insurance plan from refusing and work out federally-insured mortgages such parts.

Inside the 1935, this new FHA approved an Underwriting Instructions you to definitely put standards to possess federally backed mortgages. It supported the brand new redlining away from Black colored residential portion and indicated that mortgage loans really should not be accessible to Black group seeking flow towards light communities-since the FHA managed this would remove possessions philosophy. Since Guide indexed, incompatible racial communities shouldn’t be allowed to inhabit brand new same groups. The effect was government recognition from home-based segregation and assertion away from ventures to possess Black colored residents to amass generational wide range by way of home ownership.

Domestic districts was designated with assorted shade to indicate the particular level of risk for the mortgage credit. Roads and you will communities one to included fraction (specifically African american) and you can immigrant communities was in fact have a tendency to designated from inside the Red while the Next Degrees or Hazardous-the fresh new riskiest category for federally covered homeowner funds. For example, in the Blue city noted B3 about this map you will find a little sliver away from Red collectively Glenwood Opportunity. Notes that accompany the map describe as to the reasons: Glenwood Opportunity, which is shown from inside the red, try a vintage Negro payment until then urban area was accumulated. Furthermore, regarding the Bluish urban area aker’s cards imply: Pershing Method (ilies. Properties about this path are very terrible as well as nothing well worth.

So you’re able to Franklin Roosevelt, sufficient construction was not simply a want, but a right. Brand new Wagner-Steagall Property Work away from 1937, together with other New Offer housing and you may home loan efforts, brought greater monetary safeguards so you’re able to hundreds of thousands of Americans. Within his January eleven, 1944 Condition of your own Relationship address, FDR proclaimed good second Expenses of Rights you to definitely integrated the right of any family relations to help you a great family.

FDR upcoming spent some time working behind-the-scenes that have lawmakers and you will management officials towards the casing bill. Activities such as investment of systems, caps towards the can cost you for every device, plus the staffing and governance of your own suggested houses expert were fixed in the group meetings held in the Light Domestic. On the major issues of numerous Congressmen-and Representative. Steagall-fixed, the bill fundamentally decided to go to a ballot. President Roosevelt finalized new Wagner-Steagall Property Operate on the rules to your Sep 1, 1937.