Stress regarding the Australian Prudential Controls Authority (APRA) and come out throughout the financial royal fee enjoys lead to far tighter borrowing from the bank conditions to have refinancers and potential property owners. If you’re not well-equipped to the proper suggestions before applying for a home loan, you are from the significant likelihood of having your software denied!

Which range of information is a must-discover if you wish to get your mortgage recognized rapidly first-time as much as…

step 1. Score information out of a large financial company

Talk to a large financial company who’s accessibility a big amount of loan providers and knows which one may be the finest fit for your position. You might not understand it, but the majority lenders specialize when you look at the a particular section of home loans, for example:

- connecting finance

- family unit members guarantee finance

- money to your notice-employed

- money for all those whoever revenues derive from earnings otherwise bonuses

- interest-only finance.

Extremely brokers usually do not charge people pointers charge, so elitecashadvance.com loans with bad credit would certainly be in love not to ever use you to. Get in touch with a educated home loans so you’re able to talk about your position.

2. Minimise expenses

It seems sensible first off thinking about their living expenses at the very least 3 months out of making an application for a home loan. Opinion your own spending and you may consider ceasing month-to-month costs that aren’t essential, such as for instance an around-used fitness center membership, wine club otherwise a foundation. You can reinstate this type of shortly after your loan settles, in the event your budget enables they.

- playing cards

- shop cards

- Afterpay

- Let debts

You need to intimate down one vacant playing cards otherwise get rid of higher bank card limits since financial assumes the credit credit is at the maximum even although you pay it back every month in full. If you have costs which can be close to becoming reduced, up coming consider using a number of your deals to quit them ahead of your sign up for your loan.

3. Look at your credit history

The most famous cause for an automatic decline is actually a reduced credit rating otherwise non-payments popping up on a beneficial borrower’s credit history. Way too many borrowing enquiries on account of several mastercard software, payday advances, vehicles funds and you may numerous mortgage software have a tendency to all the wade on the cutting your credit history.

For those who have got trouble investing the expense promptly, or you has just transferred to a unique house and there is an unpaid resources expenses concealing on your credit reports, try to handle them urgently due to the fact one non-payments will teach in your credit history for five age! Since the , change on Confidentiality Operate keeps anticipate loan providers observe this new prior 2 yrs of one’s cost records with the finance and borrowing from the bank notes.

The simplest way to check your credit score is to utilize for it on the web due to Equifax. Don’t get conned into making an application for your credit score courtesy people most other merchant they are going to maintain your private information on file and spam you constantly!

4. Consider carefully your earnings

You should prove that you has secure work and income making your loan costs. Trying to get a loan when you have simply come yet another efforts are you’ll be able to, your collection of loan providers is actually greatly quicker (extremely want you so you can at the very least getting prior one probationary several months) and you may you prefer your mortgage broker to help you range your right up most abundant in compatible bank.

5. Rescue

Showing so you can a lender as possible save while also fulfilling your own living expenses is an essential part of the financing research. When you find yourself a preexisting borrower seeking refinance or most useful upwards the loan then financial should observe that you is fulfilling your duties and have now tucking certain savings away, to exhibit which you have a sound monetary ft before you go towards the more debt.

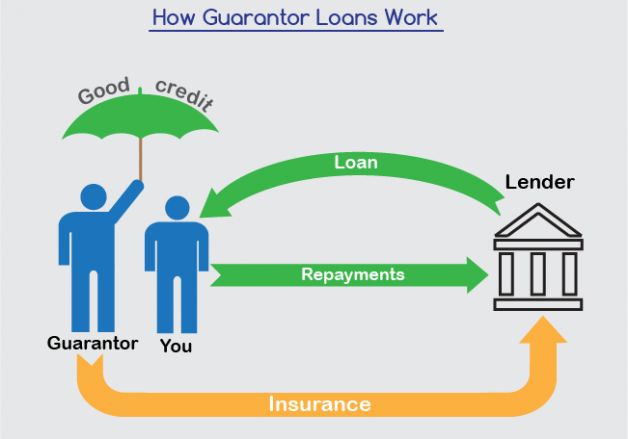

Secondly, your own deals promote in initial deposit to shop for a home. Certain loan providers need book paid to visit on the legitimate offers and using a family group make certain makes it possible to purchase good possessions as opposed to a deposit, although not lenders like to see just a bit of hurt currency going into the get.

If, like most basic home buyers, there is no need usage of a household be sure and come up with right up the latest shortfall of your 20% deposit, then you’ll definitely need certainly to save up a sizeable deposit to help you get a property. Protecting right up a 20% put to avoid loan providers financial insurance coverage (LMI) would be an excellent monumental activity. LMI may help reduce the sized the fresh deposit needed to buy a home although it does started at a high price, so the positives and negatives would be very carefully believed just before proceeding.